What to bonus deuces wild 100 hand online real money do If you learn Money otherwise a lacking Bag?

Blogs

After this bonus deuces wild 100 hand online real money several months expires, one unclaimed offers are considered uninsured. Since you commit to secure your money for a set period, you’ll have to spend a young withdrawal punishment for individuals who have to availability their financing before the label comes to an end. It’s you’ll be able to to reduce profit a great Cd for individuals who withdraw the cash through to the identity ends, while the very early detachment penalties will often go beyond the eye attained. The new financial community changed, providing far more freedom, competitive rates, and features customized to satisfy diverse economic requirements and you can timeframes. Extremely says operate unclaimed assets websites where you are able to look for any unclaimed property in your name. When it’s already been lengthy as you open your own Computer game, the lending company may have told the state that you’ve abandoned the fresh membership.

Bonus deuces wild 100 hand online real money: Believe Account

- You should buy more information about your specific deposit insurance coverage by being able to access the brand new FDIC’s Digital Put Insurance coverage Estimator(EDIE) and you will typing factual statements about your account.

- Now, the new FDIC makes sure to $250,000 per depositor for each and every FDIC-covered bank.

- Opinions conveyed here are the blogger’s alone, perhaps not those of the financial institution marketer, and have perhaps not started analyzed, acknowledged, if not recommended by bank marketer.

- Discover a lot more conditions for cash requests produced off to groups, several person, and you can minors.

In case your lender lets it, the individual making the deposit will want your name and you can membership number. For many who affect deposit a twice, the bank tend to eliminate the content transaction. The lending company need not request permission otherwise alert you that it will getting removing the fresh erroneously deposited financing.

Securing Depositors Through the a lender Failure

But not, this doesn’t mean the seller gets to contain the whole deposit in the instances of a buyer’s breach. It’s around the two people (buyer and you will supplier) to choose the level of the newest earnest money. Supplier can also be demand the newest put while the liquidated injuries in case your customer breaches the newest arrangement. Money made available to the vendor from the client and you can held inside the escrow as the in initial deposit as held until the offer closes. James said should your members of the family was able to contain the money, they would purchased in order to “bless” anybody else in need of assistance.

” for more information in regards to the kind of deposit products which try covered by FDIC insurance as well as the quantity of put insurance policies which may be readily available lower than FDIC’s other control categories. Financing products which are not dumps, such mutual finance, annuities, insurance and you will holds and you may ties, are not covered by FDIC put insurance coverage. ” for a complete list of the sorts of put products which try protected by FDIC insurance and also the quantity of deposit insurance rates visibility which can be readily available less than FDIC’s additional possession categories. To help you determine your unique deposit insurance, you can utilize the new FDIC’s Electronic Put Insurance Estimator (EDIE).

Article and you may member-made articles in this article is not analyzed or else recommended because of the one financial institution. It’s crucial that you observe that some phishing scams could possibly get fraudulently allege getting looking to reunite your together with your unclaimed possessions. Enterprises you are going to you will need to arrived at you in regards to the possessions you’ve got with these people, which’s a good idea to look at the email regularly and you can cautiously comment the brand new actual send you will get. Make sure that somebody your trust is aware of the property and in which he or she is discovered. This will make it easy for these to contact you once they have currency you to definitely falls under you. Always update your address which have a former employer or financial institution for individuals who circulate.

Research the website

To ensure the financial observe due to to the an investigation, inquire if you need to provide a study on paper. Your own financial can take around 45 weeks to research really Atm withdrawals, therefore nothing is specific until you listen to straight back from the financial. Your own financial will begin a query when you declaration the problem. However, it’s far better alert their lender of things stemming of an enthusiastic Automatic teller machine detachment instantly.

Places insured to the an admission-as a result of foundation are put into any other dumps that manager holds in identical deposit insurance policies class in one lender for reason for the brand new deposit insurance policies limitation. “Pass-through” deposit insurance policy is a method of insuring depositors whoever financing try set and you can held from the a keen FDIC-insured bank because of a 3rd party. This situation takes on that money are held inside the licensed put items from the a covered bank that are the just account that family has at the bank. The new FDIC adds along with her all places in the retirement accounts in the above list owned by a comparable people in one insured bank and you will guarantees extent to a maximum of $250,000. It area means another FDIC ownership classes plus the standards an excellent depositor have to see to help you qualify for insurance more than $250,100000 during the one covered lender.

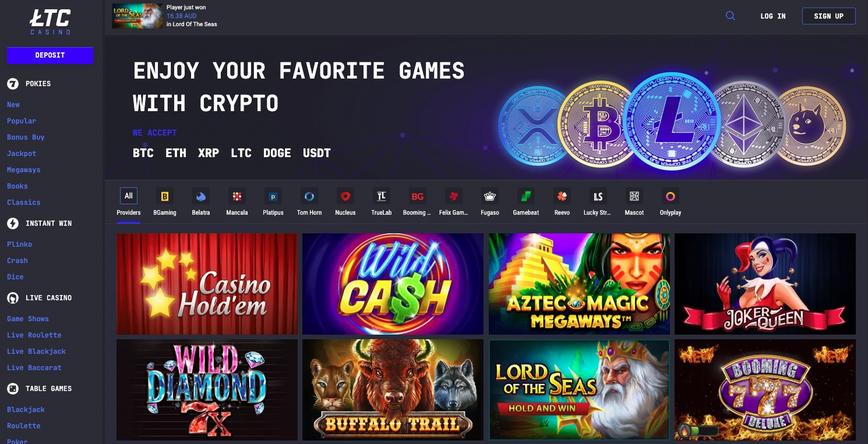

As to why Allege Gambling enterprise Incentives from Web based casinos

That’s if the bank’s financing department already been getting in touch with the woman asking for the money. “If you ask me it appears like it did not care during the the. You are aware, it actually was such, ‘We’re the lending company. I hold-all the brand new notes right here and you learn you’re you to of so many consumers, your problem is actually unimportant in order to all of us,” Sturdy states. The guy finalized the paperwork to find one to over, next needed to undo everything when the lender found the new licenses he in the first place deposited. “It is not just the worry of talking about the lending company, however it is along with the worry away from with the knowledge that my mommy requires it currency and you will this woman is counting on me to help her that have her financing,” Robust informed Wade Personal. He says needed to “chase” the financial institution to possess days, getting in touch with each week to find out in which his money try.